Electricity prices can seem complicated, especially when it comes to dynamic tariffs or real-time stock market electricity prices. But what is the difference, and why are real-time stock market electricity prices so beneficial for your company?

Real-time stock market electricity prices refer to the actual current prices that are traded directly on the electricity exchange. These prices change in real time, based on immediate supply and demand. This means: As soon as electricity is cheap, you can store it, and in some cases the price can even become negative – then you get paid to purchase electricity.

Dynamic tariffs, on the other hand, which will become mandatory for all providers from 2025, often only offer an approximation of market developments. Many providers only adjust their prices at certain time intervals, e.g. every 15 minutes or on a daily basis. This means that while you benefit from certain price fluctuations, you cannot access the best deals in real time.

????Attention: Dynamic prices do not always mean low prices. These tariffs are based on demand: When demand increases, prices also increase. Prices only become cheaper when demand is low. Real-time stock market electricity prices, on the other hand, enable you to store electricity at exactly the cheapest times, regardless of whether it is just a short-term price fluctuation or a longer trend.

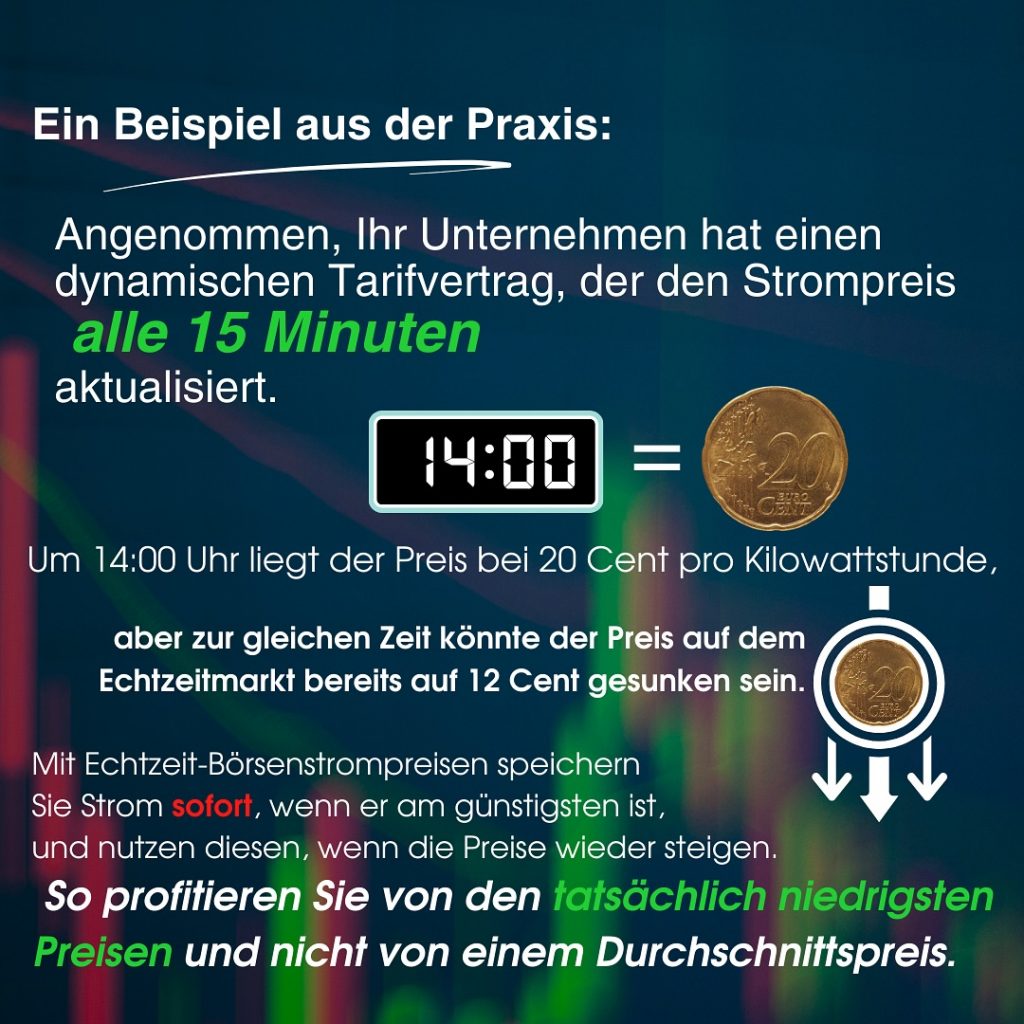

A practical example:

Let’s say your company has a dynamic tariff agreement that updates the electricity price every 15 minutes. At 2:00 p.m. the price is 20 cents per kilowatt hour, but at the same time the price on the real-time market could already have fallen to 12 cents. With real-time stock market electricity prices, you store electricity immediately when it is cheapest and use it when prices rise again. This way you benefit from the actual lowest prices and not from an average price.